Asian aviation market is on a major upswing

The Indian aviation industry is fueled by a rising middle class, govt support and fierce competition

image for illustrative purpose

ACI estimates that the Philippines, India, Indonesia and Thailand will top the fastest-growing markets between 2023 and 2042 with CAGR between 6.2%-7.2%. There is huge untapped potential in these markets

As the aviation industry in Asia takes flight, it is crucial to understand the key trends shaping its trajectory in 2024. Understanding these developments will be critical to 1) the success and strategic decisions of parties interested in the industry and 2) the overall success of aviation in Asia, as understanding related implications will provide nuanced insights into navigating the market appropriately in the coming years.

As reported by Boeing, the South Asia market is projected to become the fastest-growing commercial aviation market in the next two decades, quadrupling its aviation capacity and boasting more than 8% annual growth. IATA has reported an 8.3% surge in air cargo demand, the most substantial increase in almost two years. The aerospace market’s growth in Asia aligns with significant airport development and expansions across Asia, specifically in Thailand, Cambodia, and Vietnam.

Similarly, the air cargo segment is also experiencing a significant upward trend (+8.9% since October), where growth is likely bolstered due to rising e-commerce demand and delivery of goods from China to western markets. Seasonal events like the Chinese Lunar New Year will also play a role in boosting aviation industry, as these events will help increase air cargo and passenger demand. Similarly, popular travel destinations, such as Japan, South Korea, and Southeast Asian countries, will likely see a spike in demand.

To further enhance success, Asian aviation stakeholders can adopt best practices observed in successful cases. For airlines, practices include network optimization, digital transformation, fleet modernization, and strategic partnerships. Best practices like capacity expansion, smart airport initiatives, sustainability focus, and passenger-centric services are seen in Changi Airport, Hong Kong International Airport, Bangalore International Airport, and Incheon International Airport, respectively. In the MRO (maintenance, repair, operations) sector, practices like specialization, digitalization, regional expansion, and talent development, illustrated by ST Engineering, Safran Aircraft Engines, Lufthansa Technik, and Boeing, respectively, can enhance service quality and competitiveness. Ground handling and logistics services can adopt technology adoption, value-added services, strategic partnerships, and sustainability initiatives, as demonstrated by established players like SATS, DHL Global Forwarding and FedEx to streamline operations and reduce environmental impact. India, the third-largest and fastest-growing aviation market, showcases recovery with a doubled airport count from 74 to 141 in the last eight years. Despite having only one-fifth the size of China’s aircraft fleet, the Indian government is strategically propelling the industry through eased regulations, reduced taxes, and substantial investments in airport modernization. Further, airlines are also driving recovery via demand stimulation (fare discounts, regional connectivity, collaboration with tourism boards, and enhanced digital presence) and internal optimization (cost control, network rationalization, ancillary revenue, strategic partnerships, and technological innovation).

The Indian aviation industry is fueled by a rising middle class, government support, and fierce competition. The Union government has been promoting it with the National Civil Aviation Policy 2016, which encourages accessibility and efficiency. This is further supported by subsidies and tax breaks. These initiatives create diverse investment opportunities in airports, airlines, MRO services, cargo, drone tech, and sustainability, among many other closely related sectors.

Early movers can capitalize on high-growth potential but face challenges like competition, infrastructure bottlenecks, and talent gaps.

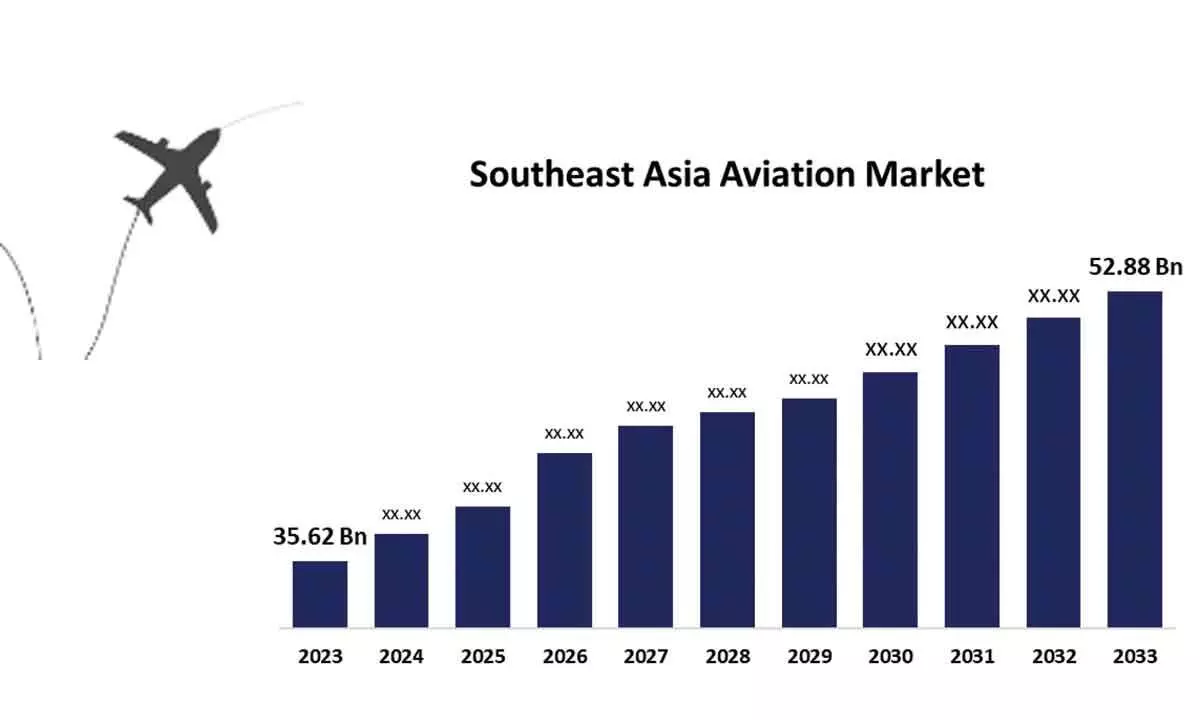

The air transport industry is also bullish on the untapped prospects of the Southeast Asian market, which is set to be among the fastest-growing regions in the world.

ACI estimates that the Philippines, India, Indonesia and Thailand will top the fastest-growing markets between 2023 and 2042 with CAGR between 6.2%-7.2%. There is huge untapped potential in these markets. Taking Indonesia as an example, only 0.32% of the 277 million population tends to use air travel. Malaysia Aviation Commission COO Raja Azmi Raja Nazuddin added in a separate panel that he sees potential in novel demand coming from Indonesia’s new capital Nusantara in the island of Borneo. The establishment of the new capital is expected to commence in the second half of 2024.

Raja added the capital will also drive the so-called BIMP-EAGA (Brunei Darussalam–Indonesia–Malaysia–Philippines East ASEAN Growth Area) region, covering the underdeveloped region east of the Association of Southeast Asia Nations (ASEAN), such as Borneo Island, Indonesian Kalimantan and south Philippines, with Brunei at the center of it all. In total, it has as a capture area of around 80 million potential passengers. Boeing's Malcom An, senior managing director for global strategic initiatives, says Indonesia has around 500 aircraft in service, but only six per cent are new-generation aircraft, opening opportunities for fleet renewal and growth.